Retroactive Tax Credits 2024 California Institute – The top California income tax rate has been 13.3% for a decade, but effective on January 1, 2024, the new top rate Yet, according to a study by the Institute of Taxation and Economic Policy. . This means that the value of the credit will be distributed to the taxpayer, regardless of whether a balance is due when filing a return. In California, the state provides a tax credit to parents .

Retroactive Tax Credits 2024 California Institute

Source : www.shrm.org

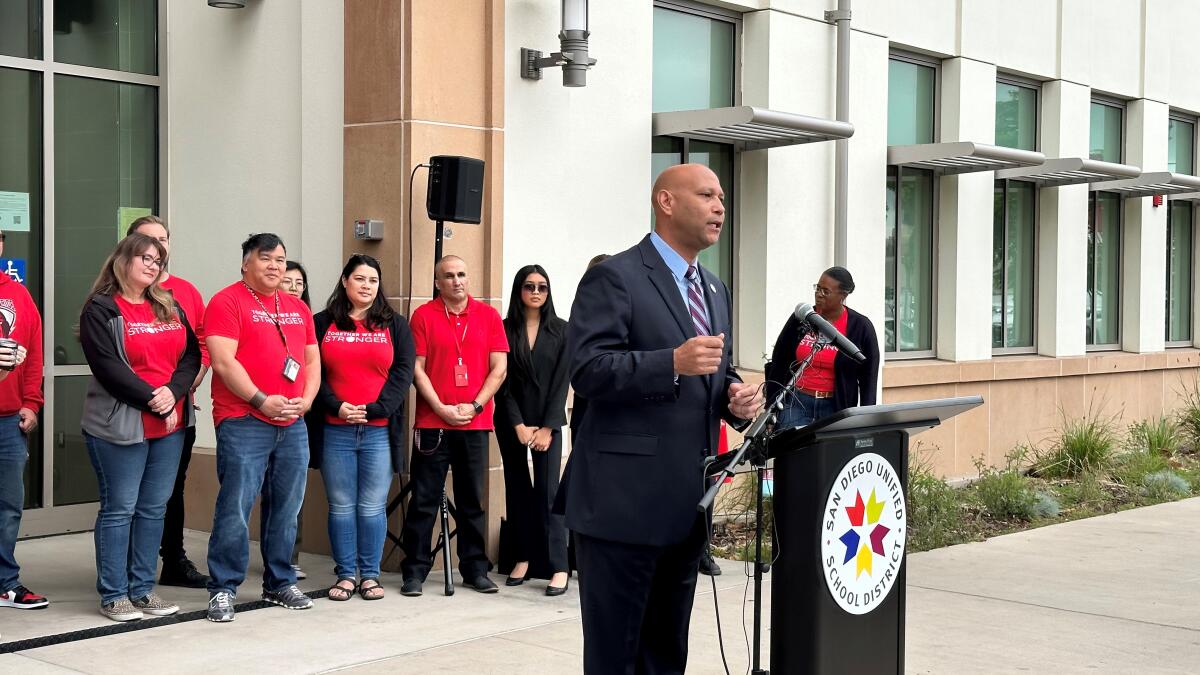

San Diego Unified school board OKs raises, teachers contract The

Source : www.sandiegouniontribune.com

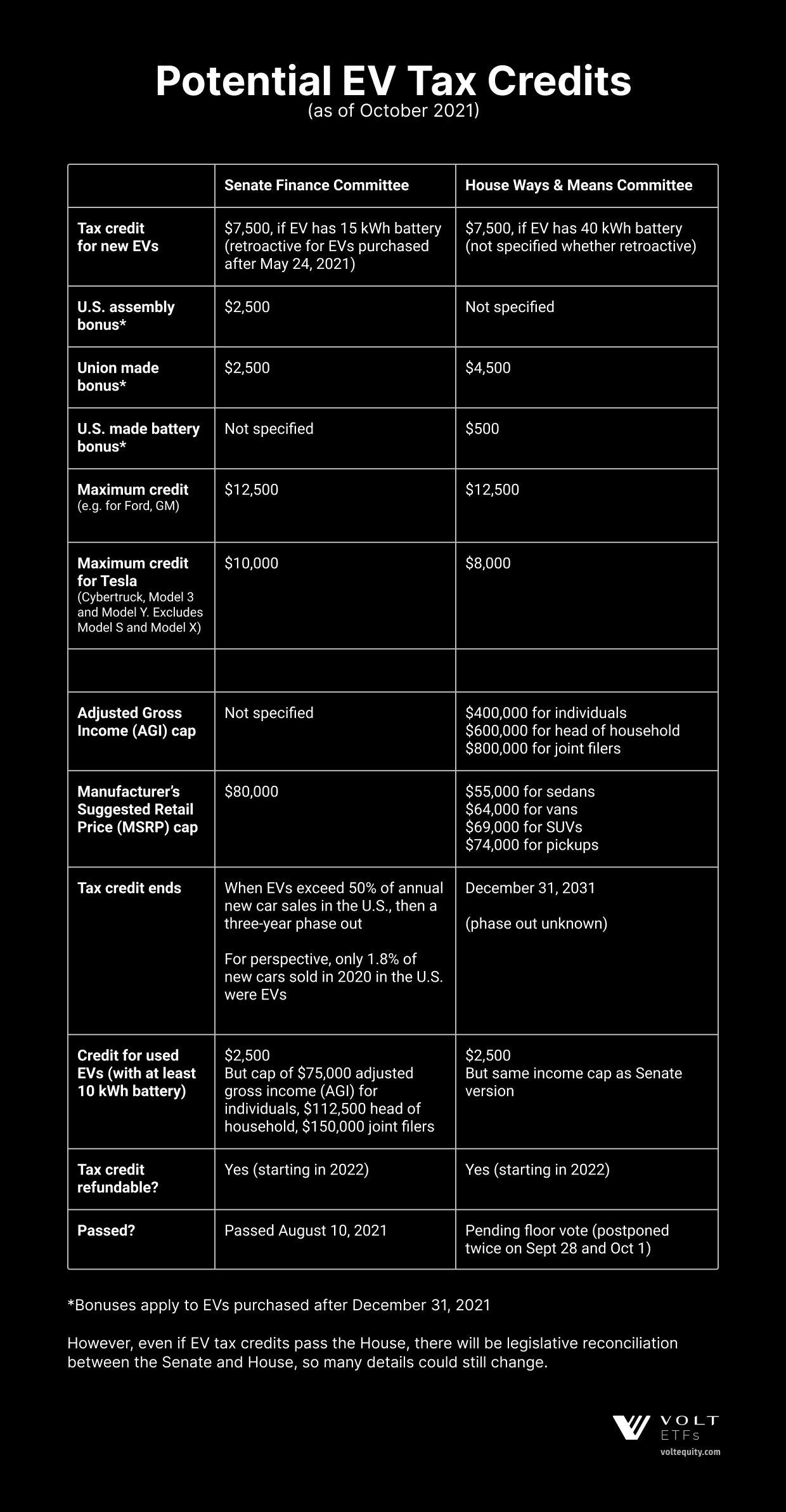

The Tesla EV Tax Credit

Source : www.voltequity.com

California Solar Incentives And Tax Credits (2024)

Source : www.architecturaldigest.com

Clean Energy Business Network | Washington D.C. DC

Source : www.facebook.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Alameda County Social Services Agency

Source : www.facebook.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

Retroactive Tax Credits 2024 California Institute Retroactive Filing for Employee Retention Tax Credit Is Ongoing : Personal Finance. Child Tax Credits 2023: What can you do if you haven’t received your refund? Personal Finance. CalFresh IRT Chart: What happens if you don’t report income change to CalFresh? . Supporters of the bipartisan tax bill needed a statement vote out of the House Ways and Means Committee on Friday to help their cause — and they sure got one. .